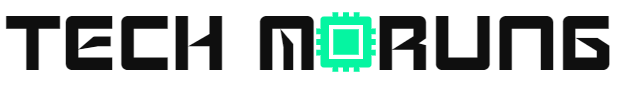

Paytm Payments Bank Limited (PPBL) has launched UPI Lite, a feature provided by the National Payments Corporation of India that allows numerous small-value UPI transactions to be conducted in real-time with just one click on Paytm. The aim of adopting UPI Lite is to promote the use of digital payments throughout the country by facilitating faster transactions, making PPBL the pioneer among payments banks to introduce this feature.

UPI Lite enables users to perform lightning-fast UPI payments with small values without worrying about the limit on the number of bank transactions. The feature simplifies the bank passbook by removing small-value transactions from it, which only appear in the Paytm balance and history section.

To use UPI Lite, users can load the wallet, which allows prompt and smooth transactions of up to ₹200. A maximum of ₹2,000 can be added twice a day, allowing a total daily usage of up to ₹4,000.

According to Praveena Rai, COO of NPCI, UPI Lite provides a faster, secure, and seamless low-value transaction experience that successfully provides a distributed way of authorizing low-value transactions, moving them away from core banking. This improves the success rate of transactions and enhances the user experience, bringing the platform one step closer to processing a billion transactions a day.

Surinder Chawla, MD and CEO of Paytm Payments Bank, said that the bank is a leader in UPI as the largest beneficiary bank, acquiring bank, and a leading remitter bank. The launch of UPI Lite empowers Indians with the power of real-time, small-value payments and helps drive digital inclusion in the country.